Below is the most detailed report on market cycles from Carl Shiovone “Understanding the Real Estate Market Cycle and Uncovering Hot Emerging Markets.”

No study of real estate investing would be complete without a comprehensive understanding of markets and how those markets are affected by economic conditions. Only through an understanding of this critical topic can the Investor properly understand their risk exposure and implement strategic investment planning and effective risk mitigation techniques.

Market Cycles

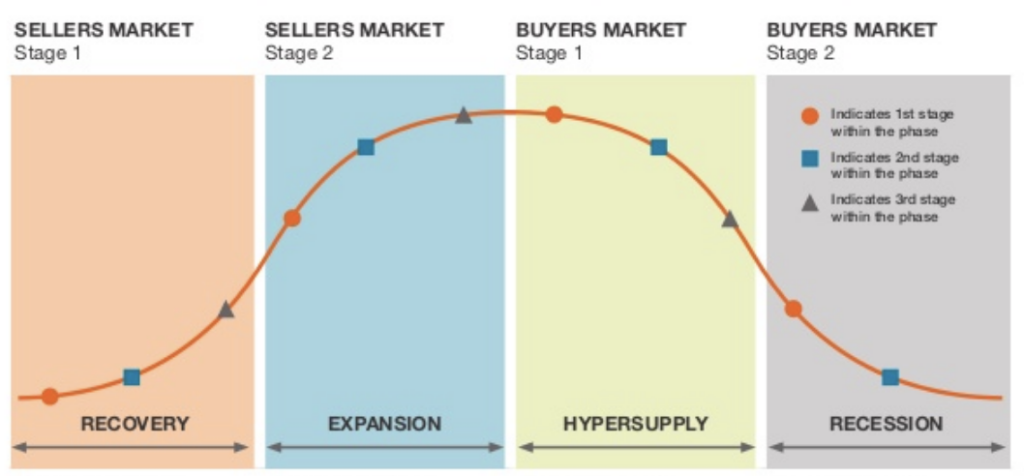

The following section will provide an overview of the four major phases of a real estate market cycle. Although each of these phases have specific characteristics that make them stand apart from one another, unfortunately, the initial transitions in and out of each phase may not be plainly obvious.

The four market phases are listed below:

– Sellers Market I (Expansion)

– Sellers Market II (Equilibrium)

– Buyers Market I (Decline)

– Buyers Market II (Absorption)

Each phase of this cycle can present the Investor with both challenges to overcome as well as opportunities to benefit from. The well informed and action oriented Investor will know what strategies to utilize during each of the phases. The following section will provide an overview on each of the market cycles.

Sellers Market I (Expansion)

During a Seller’s Market phase I (also referred to as the Expansion Phase), many of the key economic indicators are telling a compelling story that includes the following:

Due to the strong economic conditions, builders and developers regain their confidence that new construction now makes sense; significant increased activity is seen in the building permit application process. As construction levels begin to increase, it will also stimulate the need for primary and secondary workers.

The general population feels that times are good and discretionary spending increases; this in turn will help to stimulate the economy.

Market sales price and market rents are at the highest levels due to the high demand for housing; this increase in demand absorbs the available inventory and creates sometimes fierce competition among home buyers who are bidding against each other for the same property. This bidding frenzy can result in multiple offers being presented to the sellers and in some cases, bidding up the list price.

Investment Strategy

The Investors who have been holding properties coming into this phase will be benefiting from significant appreciation of their real estate holdings; this market cycle could be a great time to leverage your equity by selling at the top of the market and re-invest the proceeds in other perhaps larger properties. In order to maximize your available re-investment capital, an IRC.

1031 Tax Deferrered Exchange should be considered.

Warning! It is strongly recommended that you seek advice from your Accountant prior to implementing any tax reduction strategies.

In a market with high demand, you should expect to pay strong sales prices; the higher demand may also set the stage for sellers to be less motivated in agreeing to creative deals like seller financing, assignments, or Lease Options.

In this market, you will also see Investors who are purchasing properties just for the appreciation and are not concerned with the cash flow. For Investors who are considering this approach, it will be critical that they have adequate cash reserves available to them in the event there is an interruption of rental income resulting from vacancies. In addition, not having cash flow could make it difficult to maintain the property effectively in the event repairs or replacement is required.

During the Sellers Market Phase I, there will be numerous opportunities to take advantage of the aggressive buying activity that can exist. Outstanding profits can be realized from business models like flipping and wholesaling. This market phase will allow the Investor to get the property turned over without the concerns of a dropping market price. The fact that the property is appreciating will help create a cushion for the Investor in the event the exit strategy does not happen in accordance with the schedule and cost goals established for the project. In fact, if delays do occur, it may be possible that it could relate to more profits in the Investors pockets! At the tail end of this phase, the growth rate will start to cool down.

During the Sellers Market Phase I, Lenders will tend to be more lenient with their underwriting and approval ratio due to their confidence in the strength of the market. This can be a double-edge sword, as we have seen leading up to 2006, Lenders were approving loans for people who weren’t really qualified and as a result, when the market started to nose dive, it took many homeowners with it.

Sellers Market II (Equilibrium)

In a Seller’s Market II (also referred to as the Equilibrium Phase), many of the economic indicators are no longer exhibiting explosive growth and are heading towards national averages with regards to new construction starts, migration movement, sales price, and appreciation. Most people now recognize that the market has peaked and those who didn’t sell in the prior phase will now consider putting their property up for sale. Towards the end of this cycle, added inventory along with diminished economic incentives will reduce the demand and therefore, owners who are strongly motivated to sell will need to consider aggressive pricing strategies and open to creative deal making.

Due to the difficulties with owners selling their property, many may have to consider putting the property in rental service; this increase in available supply will drive fair market rents down.

Investment Strategy

Without proper consideration of the current declining market, business models like Flipping and Wholesaling can be risky; missed cost and schedule goals can have catastrophic results. For those Investors who are working on tight margins, it will be challenging to make the profits they are accustomed to.

If purchasing with a Hold to Rent strategy, strong walk-in equity and cash flow is vital. The equity will allow you have a good cushion in the event there is another reset to the market. Equity stripping techniques are strongly discouraged during this cycle because if you pull out all of your available equity out before a reset, you may actually end up upside down on your equity and make it difficult for you to sell the property unless you are willing and able to reach into your pockets at closing.

Buyers Market I (Decline)

In the Buyers Market I (also referred to as the Decline Phase), inventory levels and days on the market are at the highest point. Due to the continuing degradation of economic conditions which includes declining employment and little new construction, the rate of foreclosures, Short Sales, and Deed in Lieu of foreclosure will continue to increase significantly and contribute to further reductions in property values that have potentially hit the bottom.

The demand side of rental units could actually be strong during this time due to the following factors:

A higher percentage of homeowners are being displaced and may need to rent a home.

Home buyers who are able to purchase a home may hold back in fear of not knowing when the market will bottom out.

In order for a market to recover from this phase, national and/or local economic stimulus programs must be implemented to help stop the bleeding and to help to restore the confidence in the market.

Investment Strategy

When purchasing in this cycle, it will be vital to ensure strong cash flow and organic appreciation since there is no way of knowing how low the market may go. You should plan for longer hold times in order to ride out the market until it gets out of the decline phase.

Wholesaling and Flipping are difficult business models due to the fears of many buyers who are not sure when it is time to pull the trigger and make a purchase; this could result in Sellers getting stuck with inventory that is not moving.

During this cycle, it is a great opportunity for Investors to add to their investment portfolio; a strong buyer especially with all cash offers will reign supreme in this market and get the pick of the litter. This is also a great time to implement creative buying strategies and capitalize on the many Sellers who are strongly motivated to sell and will consider deals that may include Options, Seller Financing and other creative avenues.

During this phase, traditional Lenders are extremely cautious due to the uncertainty of the market. New loan applicants will be scrutinized and on higher risk loan programs like commercial lending (5 or more units), Lenders will be cherry-picking for the best applicants on the cleanest deals. Underwriting guidelines may be adjusted increased down payment, Debt Service coverage and occupancy percentages.

Buyers Market II (Absorption)

In the early stages of a Buyer’s Market II (also referred to as the Absorption Phase), the economic conditions are starting to improve. Local stimulus initiatives are underway and some results can be seen. As this phase progresses, confidence starts to be restored. Although at this point there is still only little new construction, builders and developers will eventually be convinced it now makes sense to start to build again. With the economic indicators making a turn for the better, the groundwork for an Emerging Market has been established. As employers see the need for expansion, unemployment rates will start to drop for both the primary and secondary workforce. With the improved economic conditions starting to be seen on many fronts, the oversupply of properties will start to get absorbed. As the demand side of housing increases so will the property values.

Investment strategy

In the beginning of the Buyers Market Phase II and prior to the rise in property values, the well informed Investor should accumulate as much in their portfolio as possible. Hold to rent strategies will allow you to reap the benefits of strong cash flow while riding comfortably through a market that will soon be in an upswing.

It is also important to note that although there are four distinct market phases, each phase can have its own rate of change, amount of change and total duration. Therefore, unlike the mathematical Sine Wave that may have predictable expectations, Real Estate Investors are not so fortunate in trying to anticipate future market trends.

Disclaimer: The material presented on Expand Capital Group’s website is for informational purposes only and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that we consider reliable, but we do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. Our views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results